Green Street's Time-Tested Approach to REIT Net Asset Value (NAV)

Green Street's Time-Tested Approach to REIT Valuation

Our Intrinsic NAV approach utilizes expected returns as the backbone of Green Street's proprietary stock recommendations with a proven track record for 35 years.

Download Full Methodology Download Full MethodologyWhich Real Estate Investment Trusts (REITs) are cheap?

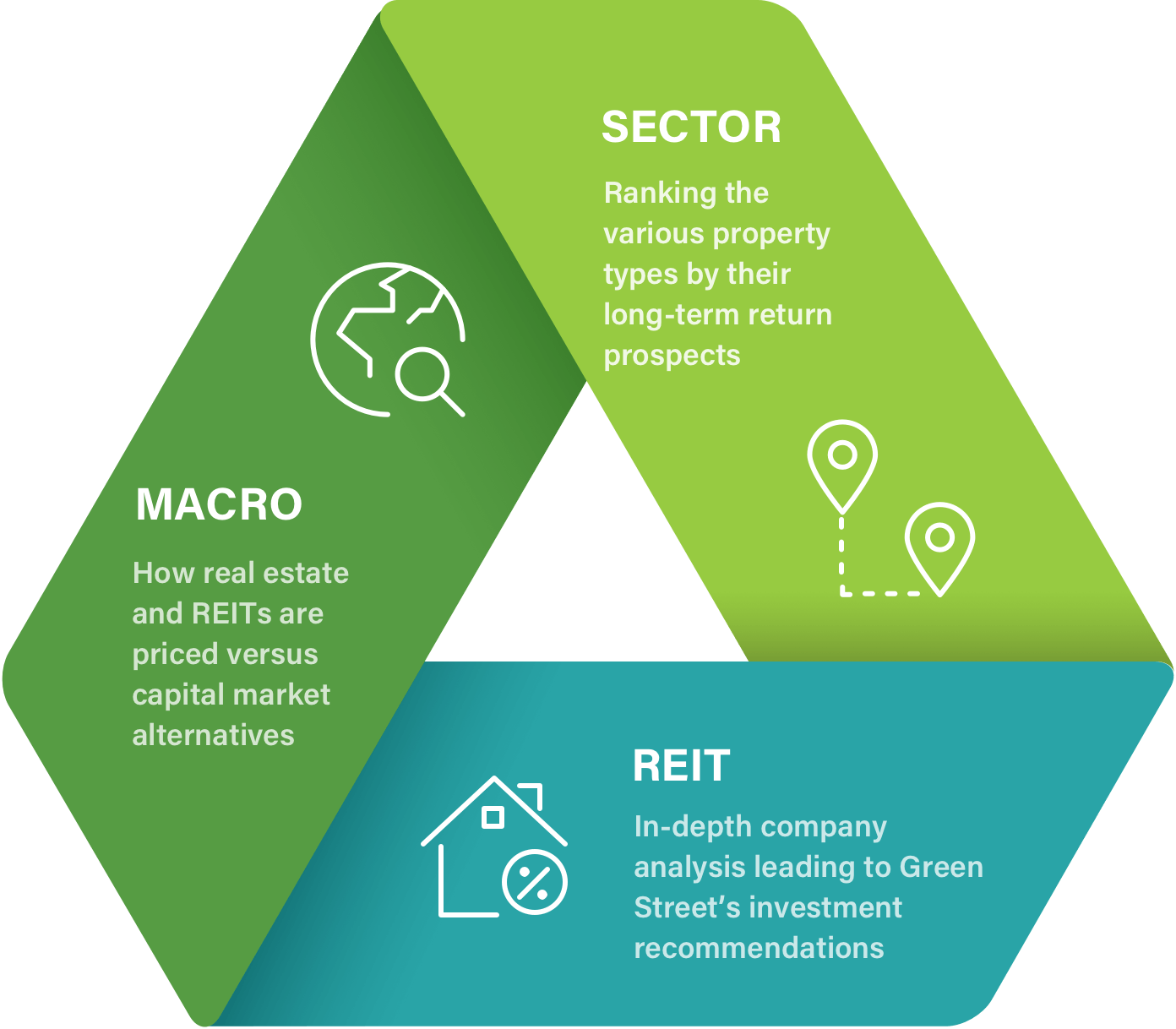

Green Street's research is rooted in our unparalleled knowledge of real estate fundamentals and valuations across the public and private markets. We have a profound understanding of the portfolios owned by real estate investment trusts (REITs) and the markets in which they operate. Our valuation methodology is based on a relative model and is designed to identify the REITs that are most- and least-attractively valued.

Assess Current Market Value

Extensive quantitative and qualitative analyses to assess the current market value of each company’s assets and liabilities. This is distilled into an estimate of net asset value (NAV) per share.

Determine Warranted Share Price

Systematic assessment of a REIT to determine its valuation relative to sector-level peers. This translates into a premium/discount to asset value at which the REIT’s shares should be valued. Applying the warranted premium/discount to the NAV estimate leads to our warranted share price.

Make Recommendations

The warranted share price is compared to the current stock price to form BUY/HOLD/SELL recommendations for the REITs in our coverage universe.

We employ a relative pricing model when conducting our REIT Data and making our company-specific recommendations. This means that there are an equal number of Buy-rated and Sell-rated stocks within each property sector. Through a multistep process, we identify which REITs are overpriced and underpriced at any point in time, thereby helping our clients make the best possible real estate capital allocation decisions. The effectiveness of the Green Street methodology is demonstrated through the impressive performance of our investment recommendations (View Track Record).

An NAV-based valuation methodology is only as good as the underlying estimate of net asset value. High-quality estimates of marked-to-market valuation require a great deal of effort and resources. Green Street’s analysts focus solely on their analytical work and providing support to our clients. Our team meets regularly with management teams, conducts numerous property tours and talks frequently with public and private market players. A core tenant of our research-driven business model is that we are independent and free from conflicts that arise from banking or brokerage affiliations.

Our model provides a systematic assessment of four key variables – franchise value, balance sheet risk, corporate governance and overhead. While it is designed to be neutral with regard to whether REITs in aggregate are cheap or expensive, investors can employ other Green Street analytic tools to help assess overall valuation and sector allocation recommendations. For example, Green Street’s RMZ Forecast Tool, which assesses overall REIT valuation compared to bonds and stocks, has proven very helpful in identifying periods when REITs are mispriced.

We believe the only way to add real value is to have a supreme understanding of all the issues that impact the value of a property, market or company from both a top-down and bottom-up approach.

Frequently Asked Questions

- Net Asset Value (NAV) estimates are far from precise. It’s very common to see NAV estimates for a given REIT spanning a broad range, with some being as much as 30% higher than others. Why base a model on such an imprecise estimate?

-

NAV is admittedly an imprecise estimate of value. It may be best to consider NAV as the midpoint of a reasonable range in which a figure at least 5% higher or lower than the midpoint might be accurate. Reasonable minds can disagree within this range. However, this lack of precision should not be viewed as a serious shortcoming. Every valuation methodology lacks precision, and alternative methodologies are almost certainly less precise than NAV. For instance, where do appropriate Price/Earnings (P/E) multiples come from? EBITDA multiples? An NAV-based approach compartmentalizes the valuation question into discrete pieces and incorporates private market pricing information, attributes that should yield a higher level of precision than a broad-brush approach to entity valuation. When analyst estimates of NAV fall well outside a reasonable range, this probably reflects the quality of the analysis, as opposed to the metric’s quality. In addition, most analysts only mark-to-market the left-hand side of the balance sheet; Green Street marks-to-market the right-hand side too. NAV calculations require a great deal of time, energy, and expertise to get right; big errors likely occur when shortcuts are taken.

- An NAV analysis is only as good as the cap rate applied to net operating income (NOI). Where does Green Street get its cap rates?

-

The choice of cap rates is the most important input in our model. Our analysts spend a great deal of time talking to market participants (e.g., REIT executives, private real estate participants, brokers, etc.), compiling databases of comparable transactions, reading trade publications, reviewing findings of providers of transaction information, and understanding the extent to which contractual rents are above or below market.

- As the Real Estate Investment Trust (REIT) industry continues to mature, analysts and investors will inevitably value these stocks the same way the vast majority of other stocks are valued. Approaches based on P/E multiples, EBITDA multiples, or discounted cash flow models will take the place of a REIT-centric concept like NAV. After all, no one tries to figure out the NAV of General Motors or Microsoft, so why bother to do so with REITs?

-

The simple answer to this question is that investors in other sectors would use NAV if they could. However, their inability to do so relegates them to using generally inferior metrics. Thoughtfully applied alternative approaches to valuation should result in similar answers to an NAV-based approach, but these other methods must be used with caution.

- REITs are more than just a collection of assets. Management matters a lot, and an NAV-based approach can’t possibly factor that in. How does the model incorporate differences in management teams?

-

Contrary to a widespread misperception, the use of an NAV-based model is consistent with a view that management is important. As long as an NAV-based model provides output with a sizable variance in company-specific warranted premiums/discounts, that model is implicitly acknowledging that management matters significantly. Capital allocation and balance sheet management are by far the key differentiators of management capabilities.

- Many REITs own hundreds of properties spread across the U.S., and an asset-by-asset appraisal would take an enormous amount of time. How can an analyst know the value of any given portfolio?

-

A reasonable NAV estimate can be derived if disclosure at the portfolio level is sufficient to allow for a comparison of the characteristics of a given portfolio with the characteristics of properties that have traded hands. No two portfolios are exactly the same, but plenty of pricing benchmarks exist to allow for adjustments based on portfolio location, quality, lease structure, growth prospects, etc.

- REITs have broad latitude in how they expense many operating costs. Can an NAV-based approach be fooled if a REIT inflates NOI by moving costs to the General & Administrative (G&A) expense line?

-

Yes. This is why an explicit valuation adjustment for G&A expense is included in our pricing model. It identifies companies that shift expenses in ways that are inconsistent with those of its peers.

- An NAV analysis derived from real estate NOI seemingly ignores capital expenditures (cap-ex). How does cap-ex factor into the analysis?

-

One of the easiest ways to make big mistakes in an NAV analysis is to utilize simple rules of thumb with regard to cap-ex. Most rules of thumb undercount the magnitude of cap-ex. In addition, the range of appropriate reserves varies hugely by property sector, property quality, and accounting practices. Each factor needs to be addressed before choosing the cap-ex reserve to utilize for a particular portfolio. The real estate portfolios in any sector that offer the highest quality, best growth, and lowest risk should be accorded the highest valuation multiples (lowest cap rates), and vice versa. Thus, it is important to rank the portfolios relative to each other and to then ensure "economic" cap rates (based on NOI less a cap-ex reserve) line up in this manner. An analysis that does not back out cap-ex costs, and is instead based off of nominal cap rates, will generate misleading relative conclusions.

- NAV is a backward looking metric. How does that take into account future performance?

-

Real estate markets are active and liquid, and when buyers and sellers agree on deal terms (e.g., cap rates, price/square foot, etc.), those terms reflect their views of future prospects. When prevailing cap rates are applied to a REIT’s forward-looking NOI estimate, the result is an estimate of value that is as forward looking as any other approach toward valuing stocks.

Please see disclosure for Green Street's stock recommendations.

Green Street's Time-Tested Approach to REIT Net Asset Value (NAV)

Green Street's Time-Tested Approach to REIT Valuation

Our Intrinsic NAV approach utilizes expected returns as the backbone of Green Street's proprietary stock recommendations with a proven track record for 35 years.

Download Full Methodology Download Full MethodologyWhich Real Estate Investment Trusts (REITs) are cheap?

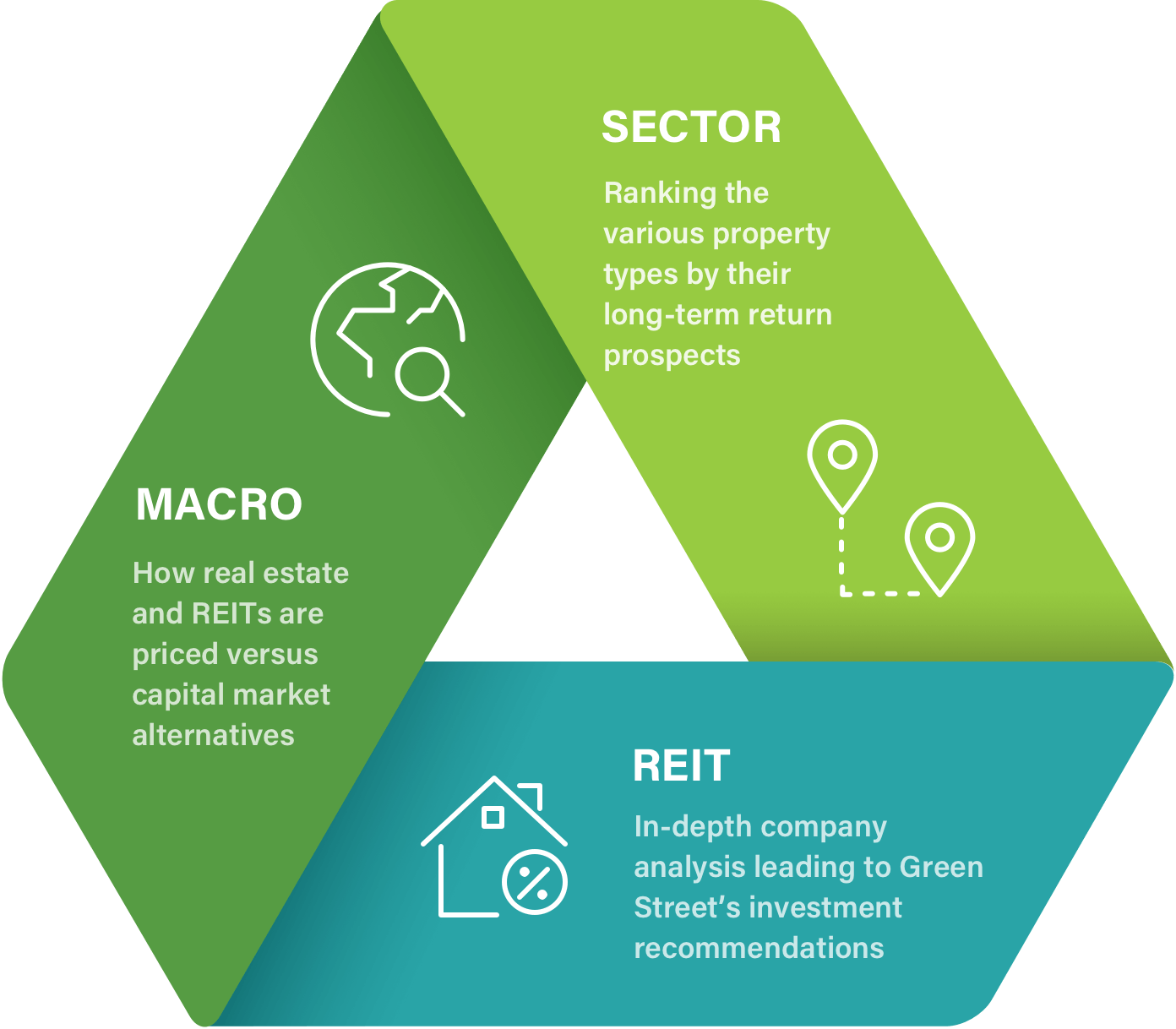

Green Street's research is rooted in our unparalleled knowledge of real estate fundamentals and valuations across the public and private markets. We have a profound understanding of the portfolios owned by real estate investment trusts (REITs) and the markets in which they operate. Our valuation methodology is based on a relative model and is designed to identify the REITs that are most- and least-attractively valued.

Assess Property Portfolio Value

Generated by extensive quantitative and qualitative analyses, intrinsic Net Asset Value (NAV) assesses how each property portfolio should be valued, rather than relying solely on signals from the private market.

Determine Warranted Share Price

Systematic assessment of a REIT to determine its valuation relative to property sector peers. This translates into a premium/discount to asset value at which the REIT’s shares should be valued. Assessing NAV plus/minus a premium for future value added by management leads to our warranted share price.

Make Recommendations

The warranted share price is used to compare valuations in relation to those of other REITs in the same property sector.

Green Street’s Pricing Model, coupled with heavy analyst input, drives our recommendations. Recommendations are market and sector neutral. While the model is designed to be unaffiliated regarding whether REITs in aggregate are cheap or expensive, investors can employ other Green Street analytics tools to help assess sector allocation issues. For example, Green Street’s RMZ Forecast Tool, which assesses overall REIT valuation compared to bonds and stocks, has proven very helpful in identifying periods when REITs are mispriced.

The effectiveness of the Green Street methodology is demonstrated through the impressive performance of our investment recommendations (View Track Record).

An unlevered IRR-based valuation methodology adjusts for quirks and inefficiencies in private-market pricing that public investors should (and do) ignore. High-quality estimates of marked-to-market valuation require a great deal of effort and resources. Green Street’s analysts focus solely on their analytical work and providing support to our clients. Our team meets regularly with management teams, conducts numerous property tours, and speaks frequently with public and private market players. The growth of our Real Estate Analytics product line has further increased the confidence that should be accorded to many of the underlying IRR assumptions, such as rent and occupancy growth across markets. A core tenant of our research-driven business model is that we are independent and free from conflicts that arise from banking or brokerage affiliations.

We believe the only way to add real value is to have a supreme understanding of all the issues that impact the value of a property, market, or company from both a top-down and bottom-up approach.

Frequently Asked Questions

- Green Street formerly used an NAV-based pricing model. NAVs are based on real transactions/values, so why change to something as imprecise as Intrinsic NAV?

-

NAV is admittedly more objective and remains the metric to focus on if one wants to compare how a REIT is trading relative to the private-market value of its real estate. Green Street has been publishing NAV estimates for three decades and will continue to ensure its NAV estimates remain the gold standard. That said, public REIT investors only care about private-market real estate values to the extent that those values fully reflect the near-term and long-term growth prospects as well as the risk profile of the real estate (i.e., if the private market is efficiently priced). Though that is often the case, sometimes the private market gets it wrong (NYC office is a good example – private market pricing has barely budged despite new construction on the West Side). If private-market pricing is incorrect, REIT investors are better off focusing on premiums/discounts to Intrinsic NAV. Green Street’s Intrinsic NAVs may be subjective, but they are often closer to "fair" value than private-market NAVs.

- How does Green Street go about determining Intrinsic NAV?

-

The first step is to estimate the expected long-term return of each REIT's property portfolio. This IRR calculation requires a lot of resources. Our estimates of near- and long-term growth rates for each REIT portfolio are determined by our dedicated team of REIT analysts who work closely with forecasts provided by our Real Estate Analytics team. Cap-ex inputs are informed by Green Street's extensive body of research on the topic. REITs with the highest risk-adjusted IRRs in a sector (adjusted for market risk, e.g., San Francisco is riskier than the Sunbelt) deserve positive adjustments to private-market value, and vice versa. A REIT whose portfolio offers a 6.6% IRR versus a sector average of 6.0% would see its intrinsic asset value increased by roughly 10%.

- Are Intrinsic NAV estimates and NAV estimates similar, or are there large differences between the two?

-

In many property sectors, Intrinsic NAV and NAV are either identical or very similar, rendering adjustments to market value unnecessary. In other property sectors – office REITs are a good example – large differences in geographic footprints, combined with the private market's excessive fondness for gateway trophies, means the underlying properties of some REITs are more attractively priced than others. In such instances, differences between Intrinsic NAV and NAV can be in excess of 15%. Most deltas are much smaller; the typical difference is in the 0% to 5% range.

- REITs are more than just a collection of assets. Management matters a lot, and an approach that is anchored to the value of the real estate – even if it uses a better value for the real estate like Intrinsic NAV does – can’t possibly factor that in. How does the model incorporate differences in management teams?

-

Contrary to a widespread misperception, the use of a model that is based on the value of the real estate can be consistent with a view that management is important. As long as that model provides output that has a sizable variance in company-specific warranted premiums/discounts (to the value of the real estate), it is implicitly acknowledging that management matters significantly. Capital allocation and balance sheet management are key differentiators of management capabilities and both are prominent features in our Intrinsic NAV-based model.

- REITs have broad latitude in how they expense many operating costs. Won’t any NAV-type approach be fooled if a REIT inflates Net Operating Income (NOI) by moving property-level costs to the General & Administrative (G&A) expense line?

-

Yes. This why an explicit valuation adjustment for G&A expense is included in our pricing model. It identifies companies that either shift expenses in ways that are inconsistent with those of its peers, or that are otherwise inefficiently run relative to peers.

- How do corporate governance practices fit in? Isn’t a REIT with good governance worth more than a REIT with poor governance?

-

Of course. Investors always prefer that a REIT has a clean governance structure and Green Street’s extensive corporate governance scoring system grades each REIT on variables such as board structure, independence, and past conduct, as well as REIT-specific issues that some generalist providers may overlook. But the value of governance is very firm specific. For a company that is an attractive takeover candidate, it can dominate the valuation question. In cases where governance is below average, but the company is otherwise well run, its impact is often limited. Corporate governance scores are not a direct input into our pricing model, but they directly impact estimated takeout odds/prices which are a large part of the valuation question (and our model) for REITs that are in play. They can also impact our assessment of franchise/management quality since good (bad) behavior often correlates with well (poorly) run companies.

Please see disclosure for Green Street's stock recommendations.