Commercial Real Estate Outlook: Are Cap Rates Heading Up?

An Inside Look at Green Street’s Forecast

When Green Street asked a conference of its top clients, “What direction do you think real estate values will move over the next 12 months?” over 70% percent of the audience said flat or up. Their optimism is not surprising. The economy is doing pretty well, and barring a trade war, economic growth is expected to pick up this year and next as the twin engines of tax cuts and deficit spending take effect. On the supply side, low supply growth has been one of the defining positive attributes of this real estate recovery, and new supply has been problematic in only a few sectors and markets. With supply and demand roughly in balance, we can expect inflationary-type rent growth for the near future.

Where Are We in the Cycle?

Steady average growth masks wide variations across property sectors, and especially between the top-performing industrial sector and the hard-hit retail sector. Most property sectors, with the exception of retail, are seeing some level of rent growth. Secular changes triggered by ecommerce are helping industrial real estate, especially infill properties, and hurting retail.

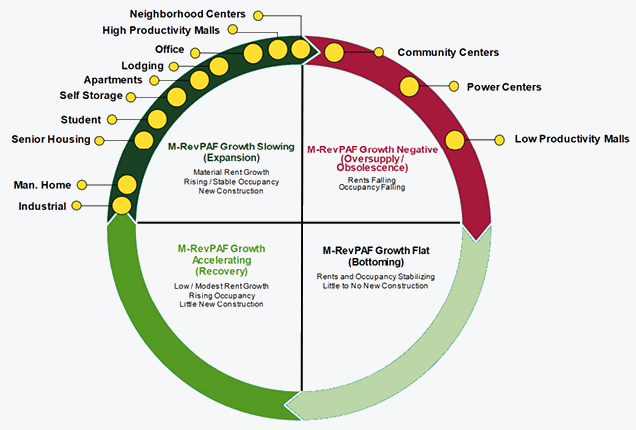

Market Revenue per Available Foot (M-RevPAF) is a Green Street metric combining changes in rents with changes in occupancies. This chart compares the five-year forecasts for M-RevPAF growth to that of the prior five years.

Market Revenue per Available Foot (M-RevPAF) is a Green Street metric combining changes in rents with changes in occupancies. This chart compares the five-year forecasts for M-RevPAF growth to that of the prior five years.Sector Winners and Losers

Green Street expects annual growth in M-RevPAF to be between -1% and 5% annually over the next five years with industrial at the high end, and strip centers at the low end. Notably, the spread in M-RevPAF growth between neighborhood shopping centers and low-quality malls is greater than 5% per annum. Overall, fundamentals are healthy, but slowing, and there are definite winners and losers between property sectors.

2018-2022 RevPAF Growth

Retail Under Pressure

The outlook for retail is concerning. Green Street is forecasting M-RevPAF declines over the next several years for lower-quality malls and power centers. The U.S. is clearly over-retailed, and these segments are most exposed to the rightsizing underway. Owners of high-quality fortress malls and well-located grocery-anchored centers are better positioned and should not be worried about survival. But they should be worried about rising capital expenditures. High-quality assets will adapt to the changing retail landscape, but doing so requires redevelopment, re-tenanting, and repositioning, and that costs money.

Value Appreciation Slows

The Green Street Commercial Property Price Indices (CPPI) track asset values for the major property sectors. Since Green Street’s indices are asset-value weighted, they have a higher weighting toward institutional-quality assets in the major metros. Recent readings reveal that value appreciation has practically stopped in aggregate. Similar to the trends in fundamentals, there are large variations by property type, with industrial being the big winner recently and malls being the big loser. Values for retail and industrial real estate have diverged by a remarkable 25% in the past 12 months.

An important takeaway is that performance has been dictated more by property sector than by geographic location. Green Street covers 50 markets for the core property sectors. While the West Coast gateway markets of Los Angeles, Seattle, and the San Francisco Bay Area have outperformed East Coast gateway markets and the Sun Belt over the past year, industrial is the top performer across the board.

Cap Rates Going Higher?

Nominal cap rates in most of the major property sectors appear to be inching up, with the exception of industrial. Bid-ask spreads have widened, and investors are more hesitant to buy and sell in light of slowing operating fundamentals and a fear of rising interest rates. Transaction volume is down this year, and would be even lower if not for the extremely accommodative debt markets.

In the case of malls, cap rates have gone up and the gap between higher- and lower-quality assets has widened considerably. Lower-quality malls are extremely difficult to finance. For power centers, cap rates have moved up notably over the past 12 months, particularly for secondary/tertiary market centers that lack a grocery component. Green Street estimates that cap rates for power centers in tertiary markets are up over 200 basis points over the past 18 months.

Green Street’s Forecast for Asset Values

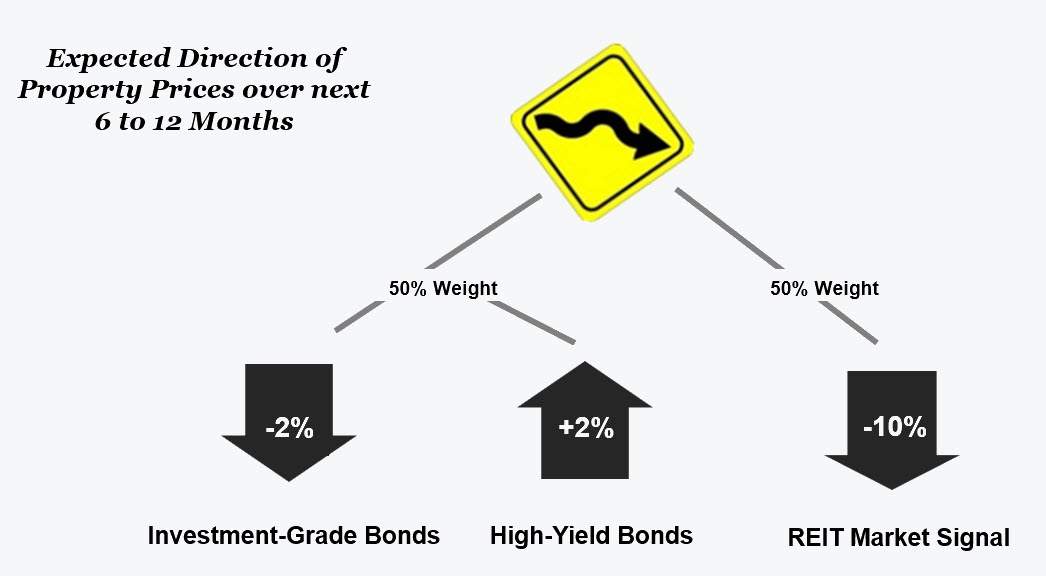

Given that property appreciation has slowed, and retail is under pressure, what’s next? Green Street publishes a Commercial Property Price Forecast based on signals from the corporate bond and REIT markets. An investor has typically garnered 150 extra basis points in yield by investing in real estate versus Baa corporate bonds. Today, that spread is right on top of its long-term average, suggesting that real estate is fairly priced compared to investment grade bonds. A comparison of real estate pricing to high yield bonds sends a slightly more upbeat, though similar signal.

Green Street also looks at public REITs for direction since the REIT market tends to be a very good predictor of the future direction of private market asset values. If REIT stocks trade at big discounts to the value of their assets, private market asset values tend to fall. If REITs trade at large premiums, private market asset values tend to rise. Commercial real estate investors who heed the signals coming from the listed real estate market have an informational advantage related to operating fundamentals and valuations.Today, REIT shares trade at fairly sizable discounts to underlying asset values, so the REIT market is saying real estate is expensive—a different signal from the corporate bond market.

Next Leg Likely to Be Down

To tie this all together: The corporate bond market says real estate is fairly priced, while the REIT market says it’s expensive. Green Street believes real estate pricing is probably a little stretched – with values expected to trend slightly lower and cap rates continuing to inch higher over the next six to 12 months. Net operating income growth will offset some, but not all, of that cap rate move. Real estate opportunities come when perceived risk diverges from real risk. Green Street’s Commercial Property Price Forecast, predicated on the reality that property prices are ultimately connected to the capital markets, has done a remarkably good job at estimating changes in the direction of property pricing.

Answer our quick survey to guide future topic areas: Do you prefer sector or macro themes? Which sectors? Which markets? Answer the poll now.

Related Resources:

- Special Report: Relative Valuation in Public & Private Real Estate Markets

- More from Joi Mar: Real Estate Disruptors Will Create Opportunities

- Learn about: Green Street's Approach to Commercial Real Estate Research

Learn more about our insights

Our thought leadership helps thousands of clients make better investment decisions every day. Inquire here to learn more about Green Street’s product suite.

More Stories

Tertiary Markets

Tertiary Markets Launch: The Biggest Little Cities

strip centers

Strip Centers: A Promising Outlook

Retail Sector